AMD meldet zweites Quartal 2022 Finanzielle Ergebnisse

“We delivered our eighth straight quarter of record revenue based on our strong execution and expanded product portfolio,” sagte AMD-Vorsitzender und CEO Dr. AMD gab heute eine endgültige Vereinbarung zur Übernahme von Pensando für ca. “Each of our segments grew significantly year-over-year, led by higher sales of our data center and embedded products. We see continued growth in the back half of the year highlighted by our next generation 5 nm product shipments and supported by our diversified business model.”

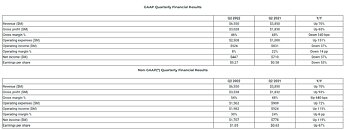

Q2 2022 Finanzübersicht

- Umsatz von $6.6 Milliarden erhöht 70% year-over-year driven by growth across all segments and the inclusion of Xilinx revenue.

- Die Bruttomarge betrug 46%, eine Abnahme von 2 Prozentpunkte im Jahresvergleich, hauptsächlich aufgrund der Abschreibung immaterieller Vermögenswerte im Zusammenhang mit der Übernahme von Xilinx. Die Non-GAAP-Bruttomarge betrug 54%, Eine Zunahme von 6 Prozentpunkte im Jahresvergleich, primarily driven by higher Data Center and Embedded segment revenue.

- Das Betriebsergebnis betrug $526 Millionen, oder 8% der Einnahmen, compared to $831 Millionen bzw 22% a year ago primarily due to amortization of intangible assets associated with the Xilinx acquisition. Record non-GAAP operating income was $2.0 Milliarden, oder 30% der Einnahmen, auf von $924 Millionen bzw 24% a year ago primarily driven by higher revenue and gross profit.

- Der Nettogewinn betrug $447 Millionen im Vergleich zu $710 million a year ago primarily due to lower operating income. Record non-GAAP net income was $1.7 Milliarden, auf von $778 million a year ago primarily driven by higher operating income.

- Der verwässerte Gewinn je Aktie betrug $0.27 compared to $0.58 a year ago primarily due to lower net income and a higher share count as a result of the Xilinx acquisition. Der verwässerte Non-GAAP-Gewinn je Aktie betrug $1.05 compared to $0.63 a year ago primarily driven by higher net income.

- Kasse, Zahlungsmitteläquivalente und kurzfristige Anlagen waren $6.0 billion at the end of the quarter and debt was $2.8 Milliarden. AMD repurchased $920 Millionen Stammaktien im Laufe des Quartals.

- Cash from operations was a record $1.04 billion in the quarter, compared to $952 Millionen vor einem Jahr. Der freie Cashflow betrug $906 Millionen im Quartal im Vergleich zu $888 Millionen vor einem Jahr.

- Goodwill und akquisitionsbezogene immaterielle Vermögenswerte im Zusammenhang mit den Akquisitionen von Xilinx und Pensando waren $50.4 Milliarden.

Finanzielle Zusammenfassung des vierteljährlichen Segments

- AMD previously announced new segments beginning the second quarter to align financial reporting with the way AMD now manages its business in strategic end markets.

- Data Center segment includes server CPUs, data center GPUs, Pensando and Xilinx data center products.

- Client segment includes desktop and notebook PC processors and chipsets.

- Gaming segment includes discrete graphics processors and semi-custom game console products.

- Embedded segment includes AMD and Xilinx embedded products.

- Prior period results have been conformed to the new reporting segments for comparison purposes.

- Der Umsatz im Rechenzentrumssegment betrug $1.5 Milliarden, oben 83% im Jahresvergleich aufgrund starker Verkäufe von EPYC-Serverprozessoren. Das Betriebsergebnis betrug $472 Millionen, oder 32% der Einnahmen, compared to $204 Millionen bzw 25% vor einem Jahr. Operating income improvement was primarily driven by higher revenue, teilweise ausgeglichen durch höhere Betriebskosten.

- Der Umsatz im Kundensegment betrug $2.2 Milliarden, oben 25% year-over-year driven by Ryzen mobile processor sales. Client processor ASP increased year-over-year driven by a richer mix of Ryzen mobile processor sales. Das Betriebsergebnis betrug $676 Millionen, oder 32% der Einnahmen, compared to $538 Millionen bzw 31% vor einem Jahr. Operating income improvement was primarily driven by higher revenue, teilweise ausgeglichen durch höhere Betriebskosten.

- Der Umsatz im Gaming-Segment betrug $1.7 Milliarden, oben 32% year-over-year driven by higher semi-custom product sales, partially offset by a decline in gaming graphics revenue. Das Betriebsergebnis betrug $187 Millionen, oder 11% der Einnahmen, compared to $175 Millionen bzw 14% vor einem Jahr. Operating income improvement was primarily driven by higher revenue, teilweise ausgeglichen durch höhere Betriebskosten. Die Betriebsmarge war vor allem aufgrund geringerer Grafikerlöse und höherer Betriebskosten niedriger.

- Der Umsatz im Embedded-Segment betrug $1.3 Milliarden, oben 2,228% year-over-year driven by the inclusion of Xilinx embedded revenue. Das Betriebsergebnis betrug $641 Millionen, oder 51% der Einnahmen, compared to $6 Millionen bzw 11% vor einem Jahr. Operating income and margin improvement was primarily driven by the inclusion of Xilinx revenue.

- Alle anderen Betriebsverluste betrugen $1.5 Milliarden im Vergleich zu $92 million a year ago due to amortization of intangible assets largely associated with the Xilinx acquisition.

Aktuelle PR-Highlights

- At its Financial Analyst Day, AMD detailed leadership roadmaps and an expanded product portfolio to deliver its next phase of growth across the estimated $300 billion market for high-performance and adaptive computing solutions, einschließlich:

- New details on the “Zen 4” core architecture, expected to deliver significant performance and power efficiency improvements over the previous generation.

- Die “Zen 5” core planned for 2024, which is built from the ground up to extend performance and efficiency leadership across a broad range of workloads.

- AMD CDNA 3 graphics architecture featuring 3D die stacking, 4th generation Infinity Architecture, next-generation AMD Infinity Cache technology and HBM memory in a single package to power what are expected to be the world’s first data center APUs, AMD Instinct MI300 accelerators.

- AMD-RDNA 3 next generation graphics architecture expected to deliver more than 50% greater performance-per-watt compared to the prior generation.

- AMD XDNA technology, the foundational architecture IP from Xilinx that consists of key technologies including the FPGA fabric and AI Engine (AIE), which is planned to be integrated across the AMD product lineup starting with the “Zen 4”-architecture based “Phönixpunkt” mobile processors planned for 2023.

- An expanded data center CPU portfolio, including the first AMD EPYC processor optimized for intelligent edge and communications deployments, Codename “Siena,” and the “Hier sind einige der ersten realen Bilder des AMD EPYC der nächsten Generation” Prozessoren, expected to be the highest performance server processors for cloud native computing at their launch planned for the first half of 2023.

- AMD completed the acquisition of Pensando Systems in a transaction valued at approximately $1.9 billion to expand AMD’s data center product portfolio with a high-performance data processing unit (DPU) and software stack. Pensando DPUs are already deployed at scale across cloud and enterprise customers including Goldman Sachs, Das Pensando-Team bringt Weltklasse-Expertise und eine nachgewiesene Erfolgsbilanz in Sachen Innovation auf den Chip, Das Pensando-Team bringt Weltklasse-Expertise und eine nachgewiesene Erfolgsbilanz in Sachen Innovation auf den Chip.

- The Frontier supercomputer, powered by AMD EPYC CPUs and AMD Instinct Accelerators, achieved number one spots on the latest TOP500, GREEN500 and HPL-AI performance lists, an industry first, and was the first supercomputer to surpass the exaflop barrier.

- The HPC industry continues to show rapidly growing preference for AMD solutions, with a 95% year-over-year increase in the number of AMD-powered systems on the TOP500 list.

- The cloud computing industry continues to show growing preference for AMD products.

- Google Cloud N2D and C2D virtual machines (VMs) are enabling enhanced security offerings with 3rd Gen AMD EPYC processors

- As part of the Oracle Cloud VMware solution product offering, new Oracle Cloud Infrastructure E4 Dense instances leverage AMD EPYC processors to deliver ideal performance for hybrid cloud environments

- Microsoft Azure is the first public cloud provider to deploy AMD Instinct MI200 accelerators for large scale AI training.

- Canon selected the Versal AI Core series for the Canon Free Viewpoint Video System to power real-time AI processing at the edge, transforming live sports broadcasts.

- AMD introduced the Versal Premium series with AI Engines, optimized for signal processing-intensive applications in the aerospace and defense and test and measurement markets.

- AMD announced that its Xilinx Zynq UltraScale+ RFSoC is enabling 4G/5G radio access network solutions to support the Meta Connectivity Evenstar Program.

- Bei COMPUTEX 2022, AMD provided new details on the new Ryzen 7000 Series desktop processors, based on the 5 nm “Zen 4” Die Mutter von allem, expected to launch this fall; the AMD Socket AM5 platform, providing advanced connectivity for the most demanding enthusiasts and gamers; und neu “Mendocino” processors bringing together “Entwickler Retro Studios sucht neue Teammitglieder” cores and AMD RDNA 2 architecture-based graphics to deliver great everyday performance in notebooks, available from OEM partners starting in Q4 2022.

- AMD announced the Radeon RX 6950 XT, RX 6750 XT und RX 6650 XT-Grafikkarten, featuring faster game clocks, faster GDDR6 memory and enhanced software and firmware compared to previous-generation products.

Aktueller Ausblick

Die Prognoseaussagen von AMD basieren auf aktuellen Erwartungen. Die folgenden Aussagen sind zukunftsgerichtet und die tatsächlichen Ergebnisse können je nach Marktbedingungen und den unten aufgeführten Faktoren erheblich abweichen “Cautionary Statement.”

Für das dritte Quartal 2022, AMD rechnet mit einem Umsatz von ca $6.7 Milliarden, Plus oder minus $200 Millionen, eine Steigerung von ca 55% year-over-year led by growth in the Data Center and Embedded segments. AMD geht davon aus, dass die Non-GAAP-Bruttomarge ungefähr bei etwa liegt 54% im dritten Quartal v 2022.

ASML Holding NV 2022, AMD continues to expect revenue to be approximately $26.3 Milliarden, Plus oder minus $300 Millionen, eine Steigerung von ca 60% zu Ende 2021 led by growth in the Data Center and Embedded segments. AMD continues to expect non-GAAP gross margin to be approximately 54% für 2022.

For more information, visit the AMD Investor Relations Website.