Bitcoin tombe sous la barre des 40 000 $, Fait espérer la disponibilité de la carte graphique

[ad_1]

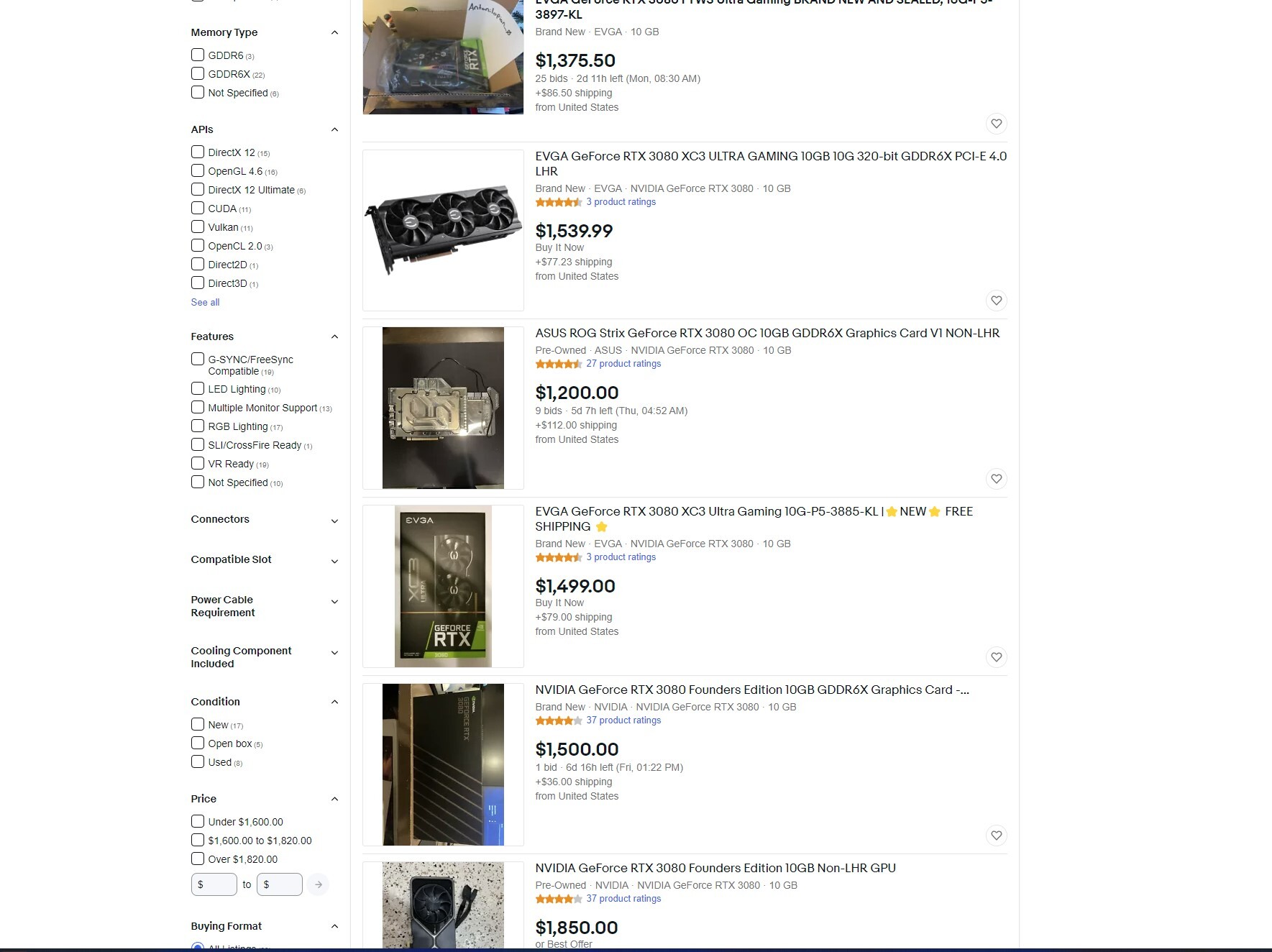

As of this writing, we see the GeForce RTX 3080 commanding a scalper price of roughly $1,500 (tout neuf), for the LHR variant (lower crypto-mining performance), while non-LHR cards that are used, start around $1,900. If the fall in cryptocurrencies continues, we could see increased availability of used graphics cards from crypto miners, as gamers would be willing to buy a used RTX 30-series or RX 6000 series graphics card that’s still within its warranty period (of 2 years).

Sales of used cards by miners will apply pressure on scalpers hording new cards to cut prices, more so as they’d be trying to sell newer batches of RTX 30-series cards that are LHR. Add to all this, the next-generation crypto-mining ASICs are on the anvil, including Bitmain’s Antminer S19 XP, and Intel’s “Mine Bonanza” ASIC that the company plans to unveil next month. The arrival of ASIC miners usually triggers an increase in the mining difficulty algorithm, which should worsen the performance/Dollar of GPUs in mining applications. The compound effect of all these, nous prédisons, could briefly improve graphics card availability in 1H-2022. A continued fall in the value of cryptocurrencies will only accelerate this.

[ad_2]