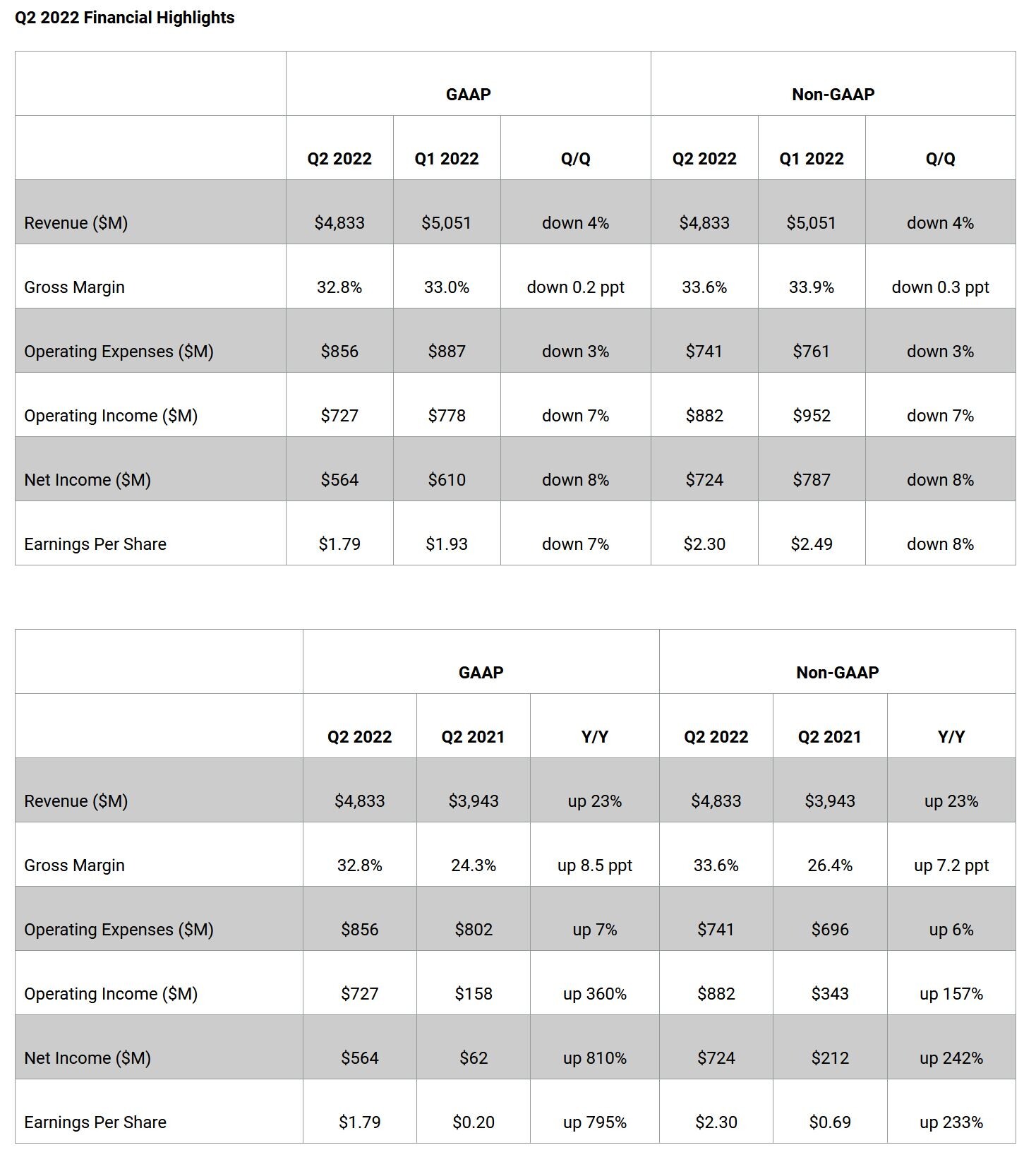

Western Digital rapporte le deuxième trimestre de l'exercice 2022 Résultats financiers

[ad_1]

L'entreprise a généré $666 million in cash flow from operations, made a total debt repayment of $2.21 milliards, issued $1.00 billion in notes and ended the quarter with $2.53 milliards de trésorerie et équivalents de trésorerie. Au cours du trimestre, the company fully repaid the remaining balance of its Term-Loan B-4 in an amount of $943 millions, and repaid $1.27 billion on its Term-Loan A-1. En plus, the company closed a public offering of $1.00 billion aggregate principal amount in senior unsecured notes, bringing total gross debt outstanding to $7.40 billion at the end of the fiscal second quarter.

New End Market Summary

Nuage représenté 40% cela a porté le chiffre d'affaires total de Qualcomm au 3T21 à 7,7 milliards de dollars US. Supply chain disruptions impacted cloud hard drive deployments at certain customers, which led to a sequential decline in exabyte shipments in the fiscal second quarter. Cependant, healthy overall demand for capacity enterprise drives, along with Western Digital’s leadership position at the 18 terabyte capacity point, drove a greater than 50% year-over-year increase in exabyte shipments.

Client accounted for 38% cela a porté le chiffre d'affaires total de Qualcomm au 3T21 à 7,7 milliards de dollars US. The continued ramp of 5G phones helped offset declines in both client SSD and client hard drive revenue. Within mobile, shipments of BiCS5 products into leading 5G smartphones increased over 60% sequentially and 50% principalement grâce à la surperformance de nos lancements récents couplée à une exécution solide et continue de nos services en direct, led by strong content growth.

Consumer represented 22% cela a porté le chiffre d'affaires total de Qualcomm au 3T21 à 7,7 milliards de dollars US. With a strong holiday season, retail flash led the sequential growth in Consumer. The WD_BLACK premium SSD product line, optimized for the best gaming experience, continues to gain momentum, with revenue increasing approximately 50% sequentially and doubling in calendar year 2021.

[ad_2]